Cryptocurrency prices fall as risk aversion due to geopolitics drops

Cryptocurrency prices fell on Friday as escalating Middle Eastern tensions triggered risk-off panic selling in financial markets, with Bitcoin (BTC) falling 5% in the past 24 hours to below $67,000, and Ether (ETH ) fell 9% to the $3,200 area. ,

Israel is ready to retaliate From Iran after recently expelling IRGC military leaders in Syria. Reports came out on Friday that America is moving warships forward To prepare itself for the defense of Israel.

🚨🇺🇸🇮🇱Just in: The United States has pledged to defend Israel if Iran attacks. Iran has said that this will make America the target of Iran. pic.twitter.com/Esn0bPXWFX

– Jackson Hinkle 🇺🇸 (@jacksonhinklle) 12 April 2024

Tension is at its peak in the Middle East since October 7th Hamas' attack against Israel, and Israel's devastating retaliatory attack on Gaza.

Growing fears that the US and Iran could be embroiled in a heated conflict on Friday.

The S&P 500 rose above a nearly one-month low of 5,100, falling 1.4% on the day.

Safe havens like the US dollar and gold have surged. The DXY rose above 106 for the first time last November, while gold briefly hit a record high above $2,400.

It's no surprise that cryptocurrency prices came under pressure – many investors consider cryptocurrencies to be high beta risk assets.

Altcoins are suffering losses due to falling cryptocurrency prices

Friday's selloff in Bitcoin was certainly mild compared to many major altcoins.

According to coinmarketcapSolana, XRP, Dogecoin, Toncoin, Cardano and Avalanche all fell between 10-16% in 24 hours.

Dogecoin, Bonk and Arbitrum were among the worst performing names in the top 100 by market capitalisation.

Friday's carnage saw a 30% drop in open interest in the altcoin cryptocurrency.

Altcoins lost ~$6 billion in open interest.

30% decline in total open interest.

Massacre.

– Zaheer (@SplitCapital) 12 April 2024

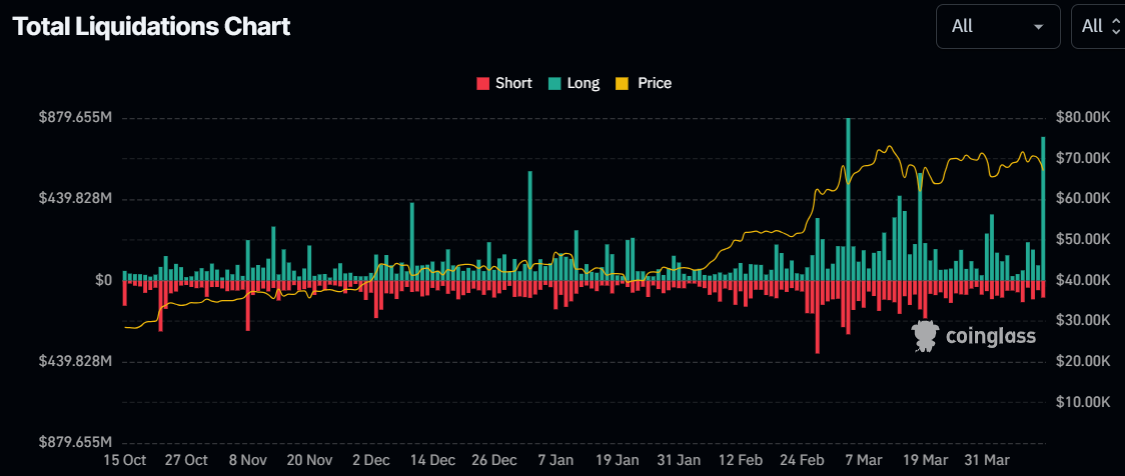

This comes after $770 million in leveraged long crypto futures positions were wiped out on Friday coinglass.com data,

Most of the altcoins mentioned above are down at least 25% from recent highs.

Some, like Arbitrum and Bonk, are down more than 50% from yearly highs.

In fact, the past few weeks had already been bad for the prices of most alternative cryptocurrencies even before Friday's rally.

After a strong end to 2023/beginning of 2024, in which many major altcoins recorded gains of 2-3x or more, with Bitcoin reaching new record highs, momentum has stalled, and profit taking has become dominant. .

Nervousness about unrest related to the Bitcoin halving, Fed rate cut bet is fading And geopolitics has added new factors to the risk.

Where next for cryptocurrency prices?

It is too early to say with certainty that the latest decline in cryptocurrency prices is over.

After all, there remains plenty of room for tensions to escalate between Iran and Israel.

The comeback of altcoins presents a great opportunity for investors to invest at bargain prices compared to a few weeks ago.

But anyone jumping into the market now should be prepared for significant two-way volatility.

Or, if they want to buy a cryptocurrency that has very little risk of a 15% intraday move in the near term, there is Bitcoin.

Yes, Bitcoin fell 5% in 24 hours due to risk-off flows. But trading at $67,000, BTC is only 8% below the record high reached last month near $74,000.

Furthermore, it remains well locked within the recent ranges.

This may reflect the fact that many people actually consider Bitcoin a safe haven asset, like gold.

And its general elasticity in recent weeks may reflect ETF optimism amid a reluctance to sell/before the halving.

Although a “sell fact” reaction after the halving could send Bitcoin down to $60,000, its outlook remains bullish.

Prices typically rise sharply to new record highs within a few months of previous halvings.

Large US deficit spending and global central bank easing suggest macro will remain a tailwind. This is even as the Fed has been comparatively slow to start cutting rates amid strong US data.

And finally, institutional demand for spot Bitcoin ETFs has added a new, long-term source of buying pressure to the market.

$100,000 Bitcoin is still planned for later this year.

And this suggests that, although the near-term outlook for altcoins is volatile, traders should be prepared for a strong comeback later this year.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You can lose all your capital.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/TEIYANDAA5GCHPE2TRSWWKJXZQ.jpg?w=660&resize=660,470&ssl=1)